A T2202 Tuition and Enrolment Certificate is issued each February to students who have paid fees for eligible courses that can be claimed on a Canadian income tax return.

You can claim the tuition fees for courses taken in the calendar year. To qualify, the fees paid to UBC Extended Learning (ExL) must be more than $100 for the year.

Please refer to the Canada Revenue Agency for all definitions and current information.

Please note that Form T2202 replaced Form T2202A in 2019 and subsequent years.

How to download your T2202 Tuition and Enrolment Certificate

T2202s are available in late February. If you’re eligible to receive this certificate, you’ll receive an email from us letting you know your certificate is ready for downloading.

To access and download your certificate, follow these instructions. You’ll need a UBC Extended Learning registration account. If you don't have an account, please contact us.

If you have an UBC Extended Learning registration account

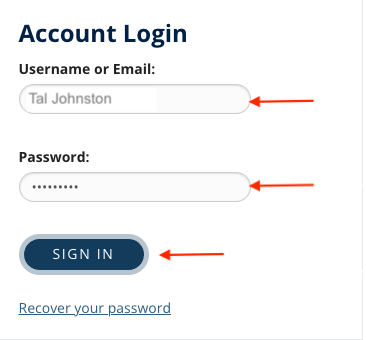

1. Login to your student registration account.

2. Enter your username or email address and password. Click SIGN IN.

If you forgot your password, please click Recover your password. If you need assistance recovering your password, you can contact us at 604 822 1444, Monday to Friday, 8:30am-4:30pm Pacific Time.

3. After logging in, you’ll see Hi, [Your Name] at the top of the page.

![Screenshot of hello [your name] screen](/sites/default/files/2024-02/step_2_-_finding_your_account.jpg)

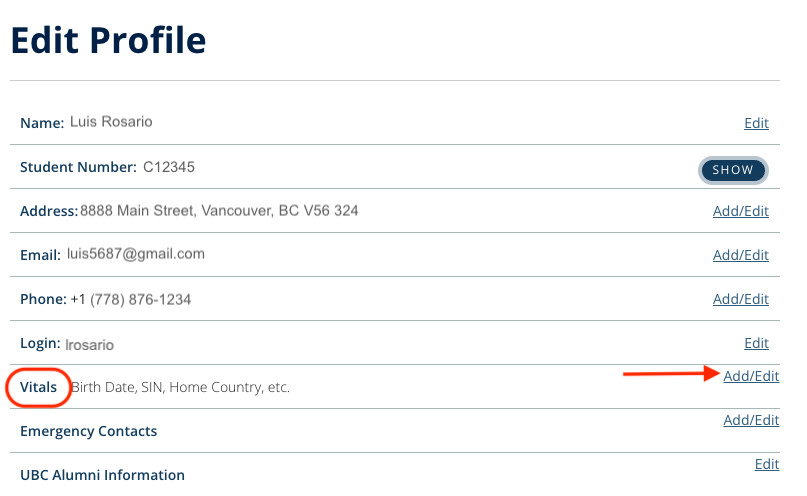

4. The CRA requires your social insurance number (SIN) be included on the T2202 form. To download your T2202 form with your SIN, you need to ensure your SIN is included in your profile under Vitals.

To check if your SIN is in your profile, click on the V arrow beside your name and a drop down menu should appear. Click Edit Profile.

![Screenshot of drop down menu, under "Hi [your name]" where you select edit profile](/sites/default/files/2024-02/step_3_-_select_edit_profile.jpg)

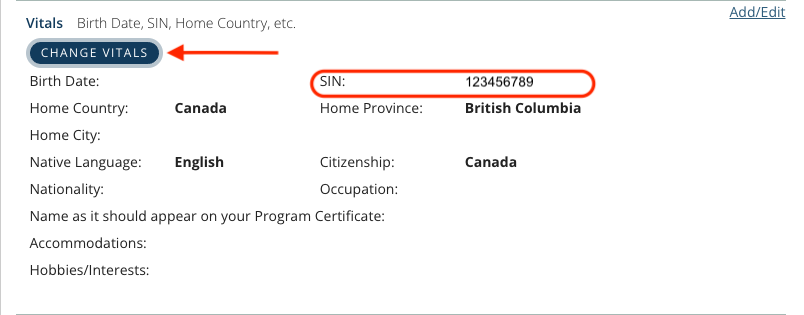

5. Click Add/Edit next to Vitals. The Vitals section will expand to reveal these details.

If your SIN is listed, you can go directly to step 6. If your SIN does not appear, click CHANGE VITALS and enter your SIN. Click SUBMIT.

6. Click again on Hi, [Your Name] and click My Reports.

![Screenshot that shows dropdown under Hi [your name] to select My Reports](/sites/default/files/2024-02/step_6_-_select_my_reports.png)

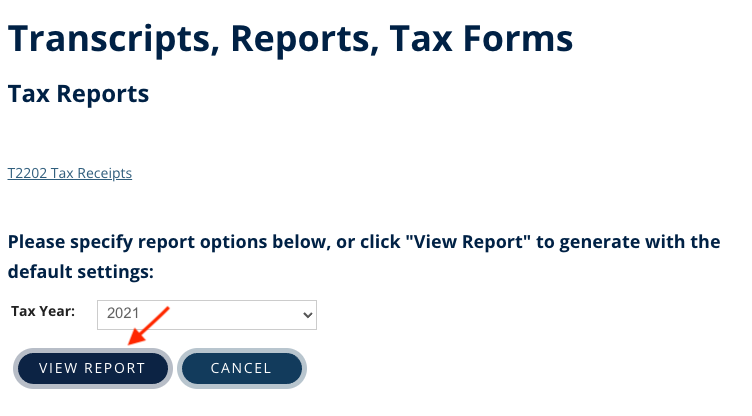

7. On the My Reports page, click T2202 Tax Receipts.

8. The default tax year should be the previous calendar year. Click VIEW REPORT. A new window will open to display the certificate as a PDF file. Clicking VIEW REPORT the first time will create an original T2202 Tuition and Enrolment certificate. Your certificate is now ready for download and printing.

If you return to your online account later and click VIEW REPORT again, it will generate a T2202 marked as duplicate.

Need more help?

If you’re not sure you have a registration account, need help logging in to your account, or have questions about accessing and downloading your T2202 tuition tax receipt, please don’t hesitate to contact us.